What is the cost of poor credit? Higher than you’d think.

Having no or poor credit can get really expensive. Without a good credit score, you can run into unexpected hurdles. Your credit may impact your ability to access:

Credit cards

Student loan refinancing

Job offers

Apartment rentals

Affordable mortgages

Affordable auto insurance rates

Household appliances

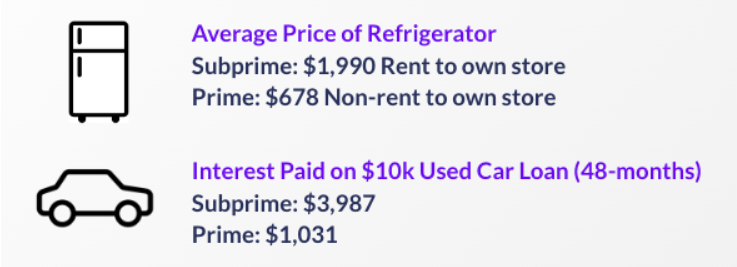

Take the following examples of the price of a refrigerator and a $10,000 car loan:

Those with the lowest credit scores spend nearly $3,000 more in interest on average to purchase a $10,000 used car. This is equivalent to a $1.40/hour raise. (Source: “What is the Cost of Poor Credit?” Diana Elliott, Urban Institute, and Ricki Granetz Lowitz, Working Credit NFP)

The difference is much bigger when you consider the impact a credit score can have on a $250,000 mortgage:

Source: American Financing

The credit system can be confusing, to say the least. Once you get down to the basics, it gets much easier to figure out what you have to do to get on top of your credit. (For a crash course on credit, check out our article, Grow & Learn: Credit 101.)